Customer Reviews Made Easy

Drive more sales with positive customer reviews!

Dr Zelman Lew

Provided a cost effective way of both accumulating and collating facebook and google reviews.

David Lam

Really happy with the level of service and communication with Chris from AddMe.

Robert Nelson

Great service and product combining all our review sites into one easy find place.

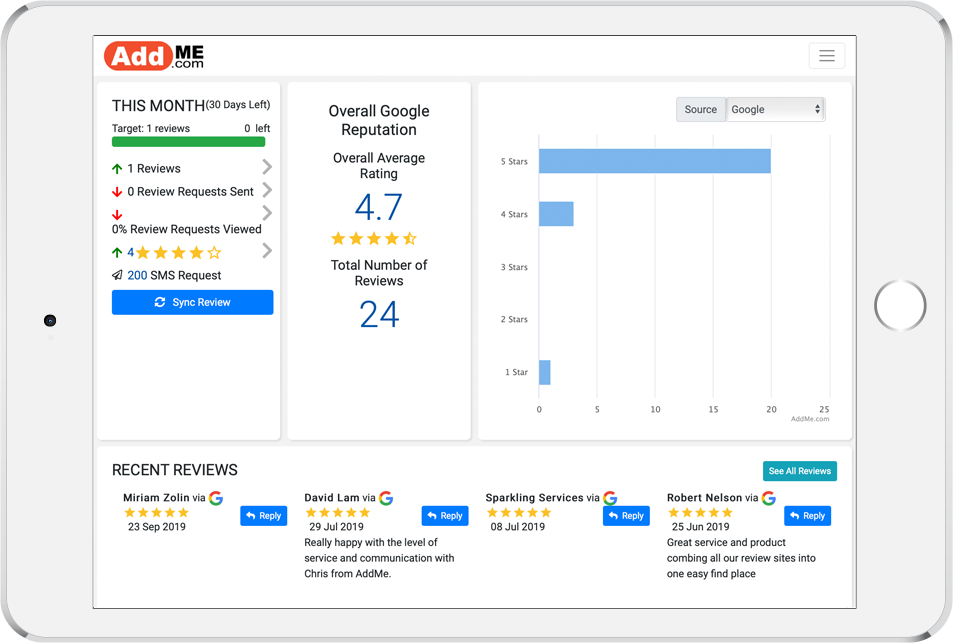

All Of Your Reviews

AddMe Reviews enables you to collect and manage your customer reviews from leading online business review sites in one place.

Our Reviews Platform makes it easy to ask customers to leave positive reviews.

More Stars, More Sales

Grow Your Business

Drive more sales for your business through the power of positive customer reviews.

- Increase exposure on Google

- Boost your online reputation

- Manage your reviews and engage with customers

AddMe Reviews provides a simple solution for businesses to take control of their online customer reviews. Make it easier for your customers to provide positive feedback and keep informed about new business reviews.

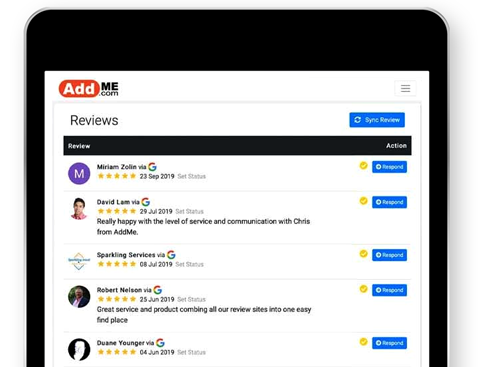

Monitor And Respond

Engage with and respond to reviewers across multiple sites with an easy-to-use interface.

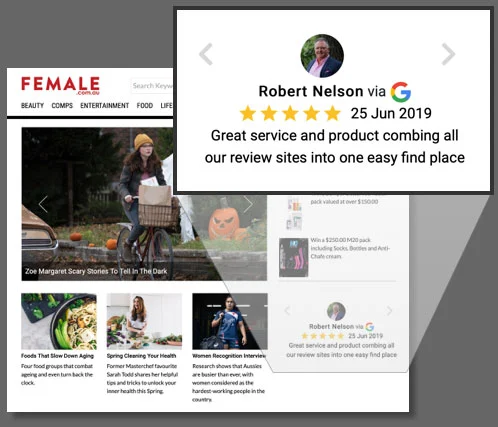

Increase Exposure

Word of mouth marketing is one of the most cost effective marketing tools any business can use. Automated tools can promote reviews through social media as well as streaming reviews on the business’s own website.

Used For A Range Of Different Businesses

Car Dealerships

Mechanics

Auto Retailers

Car Detailers

Dentists

Physiotherapists

Chiropractors

Personal Trainers

Electricians

Plumbers

Builders

Gardeners

Real Estate Agents

Property Valuers

Mortgage Brokers

Property Managers

Clothing Stores

Furniture Stores

Office Supplies

Sporting Goods